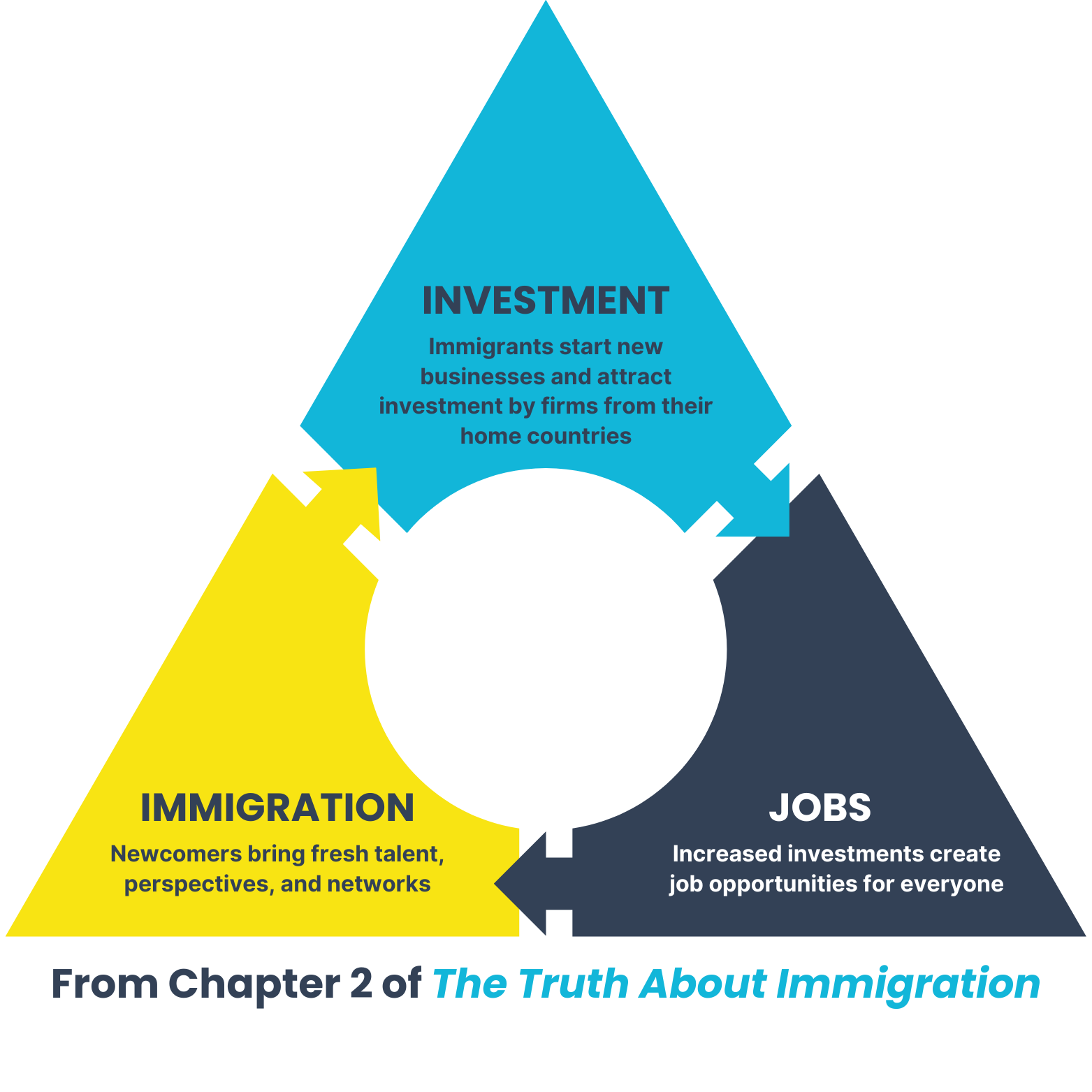

What’s the link between immigration, investment, and jobs?

Key Points on Immigration and Investment

- Investment Magnet: Immigrants attract investments from their home countries and start businesses in their new communities.

- New Business Powerhouse: Immigrants are 80% more likely than natives to start businesses—from corner restaurants to high-tech startups. Half of “unicorns” (startups with a $1B valuation) and nearly half of the Fortune 500 are founded by immigrants.

- Job Creation: These investments create countless jobs, mainly for native-born workers, and the businesses started by immigrants pay a significant amount in taxes.

- Economic Diversification: The investment effect leads to a more diversified economy, which leads to more stable and faster economic growth.

Free Download

How To Talk About Immigration

Conversations about immigration can be challenging due to its politicization, leading to avoidance, echo chambers, or confrontations.

This guide offers principles based on expert research and the author’s experiences, aimed at facilitating constructive discussions about immigration.

Prompting Meaningful Dialogue

Use these questions to spark thoughtful conversations about the economic impacts of immigration.

- How does immigration lead to increased investment in local economies?

- Make a list of the 20 companies you interact with most commonly as a consumer. Look up their origin story. How many of them were started by an immigrant?

- What examples from your community can you think of where immigrants have spurred economic growth?

Further reading and research:

Ready to learn more? Access detailed studies, articles, and reports that provide a factual, in-depth look at the contributions and impacts of immigrants in our society.

- Michael Grothaus, “Some of the U.S.’s Biggest Companies Are Founded by Immigrants,” Fast Company, July 26, 2018, https://www.fastcompany.com/90202816/some-of-the-u-s-s-biggest-companies-are-founded-by-immigrants

- Exequiel Hernandez, “Finding a Home Away from Home: Effects of Immigrants on Firms’ Foreign Location Choice and Performance,” Administrative Science Quarterly 59, no. 1 (2014): 73–108.

- Yong Li, Exequiel Hernandez, and Sunhwan Gwon, “When Do Ethnic Communities Affect Foreign Location Choice? Dual Entry Strategies of Korean Banks in China,” Academy of Management Journal 62, no. 1 (2019): 172–95.

- Konrad B. Burchardi, Thomas Chaney, and Tarek A. Hassan, “Migrants, Ancestors, and Foreign Investments,” Review of Economic Studies 86, no. 4 (July 1, 2019): 1448–86, https://doi.org/10.1093/restud/rdy044.

- Changjun Yi et al., “Migration Networks and Subsidiary Survival of EMNCs: The Mediating Effect of Entry Mode,” Managerial and Decision Economics 43, no. 6 (2022): 2299–2310, https://doi.org/10.1002/mde.3526

- Subramanian Rangan and Metin Sengul, “The Influence of Macro Structure in the International Realm: IGO Interconnectedness, Export Dependence, and Immigration Links in the Foreign Market Performance of Transnational Firms,” Administrative Science Quarterly 54, no. 2 (2009): 229–67;

- Benjamin A. T. Graham, Investing in the Homeland (Ann Arbor: University of Michigan Press, 2019)

- David Leblang, “Familiarity Breeds Investment: Diaspora Networks and International Investment,” American Political Science Review 104, no. 3 (2010): 584–600;

- Alexandra O. Zeitz and David A. Leblang, “Migrants as Engines of Financial Globalization: The Case of Global Banking,” International Studies Quarterly 65, no. 2 (June 8, 2021): 360–74, https://doi.org/10.1093/isq/sqaa084

- Dany Bahar, Christopher Parsons, and Pierre-Louis Vézina, “Refugees, Trade, and FDI,” Oxford Review of Economic Policy 38, no. 3 (September 1, 2022): 487–513, https://doi.org/10.1093/oxrep/grac022

- Claudia M. Buch, Jörn Kleinert, and Farid Toubal, “Where Enterprises Lead, People Follow? Links Between Migration and FDI in Germany,” European Economic Review 50, no. 8 (November 2006): 2017–36.

- Jaerim Choi, Jay Hyun, and Ziho Park, “Bound by Ancestors: Immigration, Credit Frictions, and Global Supply Chain Formation,” Working Paper 31157, National Bureau of Economic Research, April 2023, https://doi.org/10.3386/w31157.

- Sarath Balachandran and Exequiel Hernandez, “Mi Casa Es Tu Casa: Immigrant Entrepreneurs as Pathways to Foreign Venture Capital Investments,” Strategic Management Journal 42, no. 11 (2021): 2047–83.

- C. Fritz Foley and William R. Kerr, “Ethnic Innovation and U.S. Multinational Firm Activity,” Management Science 59, no. 7 (July 2013): 1529–44, https://doi.org/10.1287/mnsc.1120.1684

- Anna-Maria Mayda, Christopher Parsons, Han Pham, and Pierre-Louis Vézina, “Refugees and Foreign Direct Investment: Quasi-Experimental Evidence from US Resettlements,” Journal of Development Economics 156 (May 1, 2022): 102818, https://doi.org/10.1016/j.jdeveco.2022.102818

- Diego Useche, Ernest Miguelez, and Francesco Lissoni, “Highly Skilled and Well Connected: Migrant Inventors in Cross-Border M&As,” Journal of International Business Studies 51, no. 5 (July 1, 2020): 737–63, https://doi.org/10.1057/s41267-018-0203-3

- Vera Kunczer, Thomas Lindner, and Jonas Puck, “Benefitting from Immigration: The Value of Immigrants’ Country Knowledge for Firm Internationalization,” Journal of International Business Policy 2, no. 4 (December 1, 2019): 356–75, https://doi.org/10.1057/s42214-019-00034-9

- Dany Bahar, Andreas Hauptmann, Cem Özgüzel, and Hillel Rapoport, “Migration and Knowledge Diffusion: The Effect of Returning Refugees on Export Performance in the Former Yugoslavia,” Review of Economics and Statistics, January 25, 2022, 1–50, https://doi.org/10.1162/rest_a_01165

- Dany Bahar, Hillel Rapoport, and Riccardo Turati, “Birthplace Diversity and Economic Complexity: Cross-Country Evidence,” Research Policy 51, no. 8 (October 1, 2022): 103991, https://doi.org/10.1016/j.respol.2020.103991

- Dany Bahar, Natalie A. Carlson, and Exequiel Hernandez, “Shades of Adaptation: Immigrant Employees and the Global Product Lifecycle in Multinational Firms,” working paper, Wharton School, University of Pennsylvania, n.d.